Roberts Insurance Group Blog |

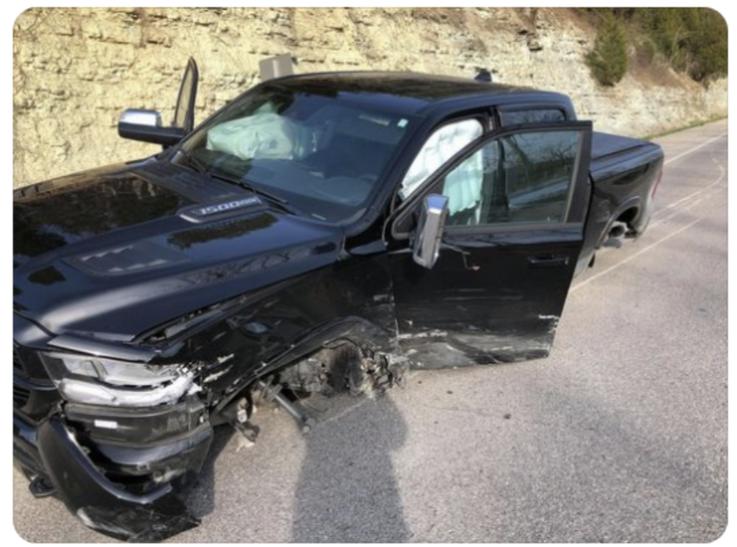

One of the BIGGEST misconceptions by Georgia drivers is that having "full coverage" means that they will be fully covered in the event of an accident. This is dangerous and could leave you, your family, or your business exposed and subject to hundreds of thousands of dollars in unforeseen costs in the event of an accident. The truth is, there's no such thing as full coverage. Now, when someone tells me they have full coverage, I do know what they mean by that. "Full coverage" typically means that someone carries comprehensive and collision coverage on their auto policy. These are the coverages used to fix or replace your vehicle if it is damaged and there is not another at-fault party. These are the coverages required if you are financing or leasing a vehicle. So why is there no such thing as full coverage? Even if you have "full coverage" you are still going to be subject to deductibles and the limitations on your policy. For example, if you have a $500 collision deductible, you're going to be responsible for the first $500 in damages to your vehicle before your auto insurance policy will begin to pay out. Also, if you have an accident and there's $100,000 in property damage and you only have $25,000 in property damage liability, your policy will pay out the $25,000 property damage liability limit and you would be responsible for the remaining $75,000. These are just 2 examples. How is having "full coverage" dangerous? This can best be explained by an experience that happened to a friend of mine. We'll call him Joe. One afternoon, Joe and his wife Sarah were driving home from lunch. On the way home, another driver veered into their lane and hit them head on. Thankfully, all parties involved were OK aside from a little soreness. What was not OK was Joe's new Ram pick up truck. The picture here is an actual picture of Joe's truck at the accident scene. Joe bought the truck brand new and had only had it for a few months. It was valued at the time of loss of around $65,000. The truck was deemed a total loss. The at-fault driver thought all was well because he had "full coverage". Little did he know that he had the Georgia state minimum liability limit requirements, which only provides $25,000 of property damage liability. The at-fault driver's insurance company paid the $25,000 with ease, leaving him a remaining balance of $40,000 owed to Joe and Sarah. Where did he come up with the $40,000? He didn't. What happened was, Joe and Sarah had to file an underinsured motorist claim on their personal auto policy to cover the difference in what was paid by the at-fault driver's policy and what the truck was valued at. After all, insurance is designed to indemnify you or make you whole again. Joe and Sarah's policy paid the remaining $40,000 with ease because Joe was correctly insured. Joe and Sarah went out and got a new truck the next day. So what happened to the at-fault driver? Joe and Sarah's insurance company took him to court and sued him for the $40,000 they had to pay as the result of him being underinsured. The at-fault driver, not having an extra $40,000 laying around, ended up having a judgment against him in the amount of $785 being garnished from his paycheck until the debt is repaid. This is almost as much as his monthly mortgage payment. So, in essence, he is not stuck having to pay the equivalent of TWO mortgage payments every month for the next 4 and a half years! Can you imagine what his life would be like if Joe and Sarah were hurt or killed in the accident? If they had hundreds of thousands of dollars in medical expenses and lost wages? This at-fault driver would be getting far more garnished from his paycheck for a MUCH longer period of time. So what is the moral of the story? The moral of the story is that, even if you have "full coverage" you're not fully covered. Even if you have $5,000,000 of liability insurance connected to your personal auto policy, you'll still be stuck having to pay out of pocket for everything over the limits in your policy. Your policy has limits that WILL NOT be exceeded. This is why it is important to review your coverage with your agent to make sure you have the right coverage. The Roberts Insurance Group is a Georgia Insurance Broker specializing in commercial and personal insurance for our clients throughout the state of Georgia. We help our clients lower their cost of insurance with our superior claim and risk management expertise and our extensive carrier access. We are in the business of building relationships with our clients to help them grow and succeed. Contact us today to see what we can do for your family or business.

0 Comments

Leave a Reply. |

Contact Us(678) 250-8133 Archives

February 2022

Categories |

RSS Feed

RSS Feed